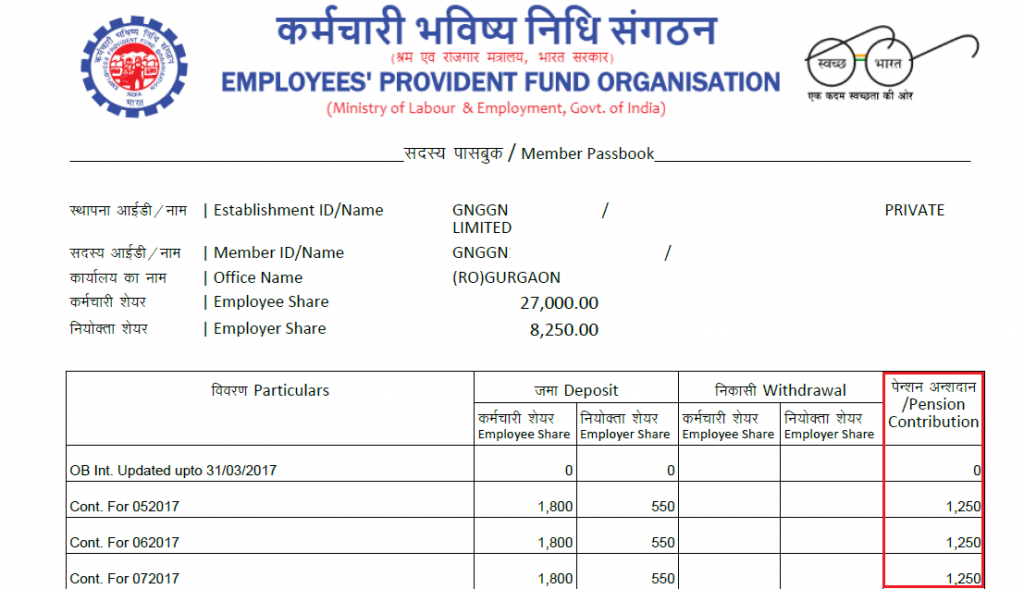

This 12 however is divided into two accounts-1. The EPF interest rate for FY2020-21 was 850 unchanged from FY2019-20.

How To View Epf Passbook And Track Contributions Interest Transfer Withdrawal

Contribution by assessee for self employed Section 80CCD1b Eligible for tax deduction upto 20 of his gross total income of the previous year with effect from Assessment year 2018-19 under section 80 CCD1 within the overall ceiling of.

. Updating and uploading of all Central Acts available on this web page is the proprietary of the Legislative Department in the Ministry of Law and Justice. The last date to update and add nominees to ones Employees Provident Fund EPF account is December 31 2021. The updating and uploading of Rules Regulations Notifications etc and linking them with relevant sections of the respective Principal Act under which the said subordinate legislations have been made is the.

EPF is calculated on the salary where salary Basic DA Dearness Allowance In private organisations salary Basic. The Employees Provident Fund Organization EPFO Central Board of Trustees after consultation with the Ministry of Finance reviews the EPF interest rates every year. But from now onwards it includes BasicDAAllowances.

3702018-Employees Provident Fund Amendment of Third Schedule Order 2018. In my first member id contribution is till Sep 2018 pl advise till which dateyear I am eligible to get the epfo interest. Contribution to EPF will be 12 of Rs46000 which is Rs5520.

More contribution of Rs1920 but less take home from now onward. It was first implemented in January 2018 by. From above example you may see a cut in your take home pay.

So your total salary from above example will be Rs46000. As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. That means 12 of your salary goes into your PF account.

EPF contribution into an employees EPF account is made every month in equal proportion both by the employer and the employee. The table must mention the incorrect entry plus the corresponding right entry. Jadual PCB 2020 PCB Table 2018.

A certain amount of their salary is deducted and deposited in the account along with some contribution from the employer which. SIP EIS Table. Your employer needs to contribute 12 too.

But this rate is revised every year. A late payment interest rate of 6 per year is imposed for each day such contribution is not paid on time. However many users and account holders are finding it difficult to add nominees to their account.

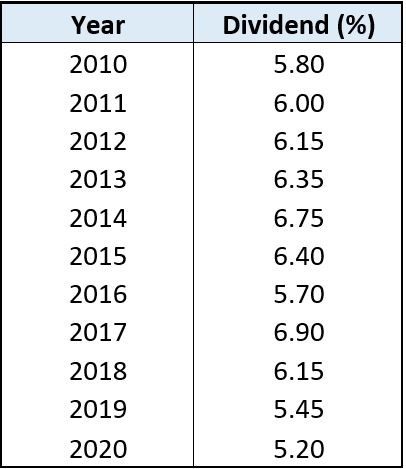

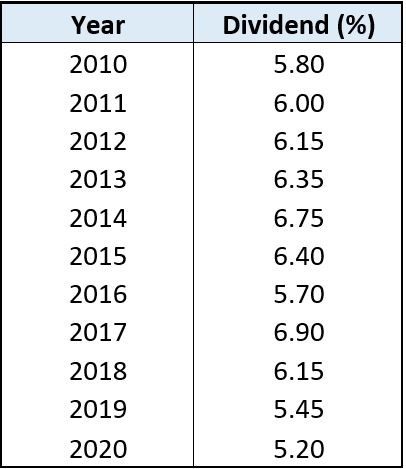

EPF Interest Rate. As of now the EPF interest rate is 850 FY 2019-20. Chetan on March 21 2018 at 402 PM How to link PAN with epf My aadhar is already link with epf.

Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India. How to calculate Tax on EPF Interest above 25 lakhs With. 1A Subject to section 52 the monthly contribution of every employee and employer who are subject to the minimum wages order made under the National Wages Consultative Council Act 2011.

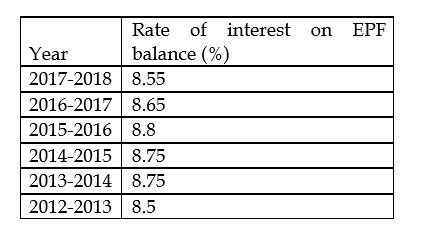

The EPF contribution rate table is as below. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. February 1 2018 at 1040 am.

The review of the EPF interest rate for a financial year is set at the end of that financial year most probably in February but may go up to April or May. EPF Contribution Third Schedule. Examples of Allowable Deduction are.

Details will be updated by 28-03-2018. Similar to EPF SOCSO contribution will be deducted from both employees and employers funds and will be paid every 15th of each month. EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000.

Once there is a contribution by an employer PANBank Details would be allowed as they have to be verified and approved by the employer. The below table helps you understand the contribution in the Employee Provident Fund. The EPF interest rate is reviewed every year by the EPFO Central Board of Trustees after consultation with the Ministry of Finance.

EMPLOYEES PROVIDENT FUND ACT 1991. The EPF contribution is either 1800 INR per month or 12 of the salary.

30 Nov 2020 Bar Chart Chart 10 Things

8 Mac 2021 Commercial Marketing D I D

What Is Employees Pension Scheme Eps Eligibility Calculation Formula

Pdf Employees Provident Fund Epf Malaysia Generic Models For Asset And Liability Management Under Uncertainty Semantic Scholar

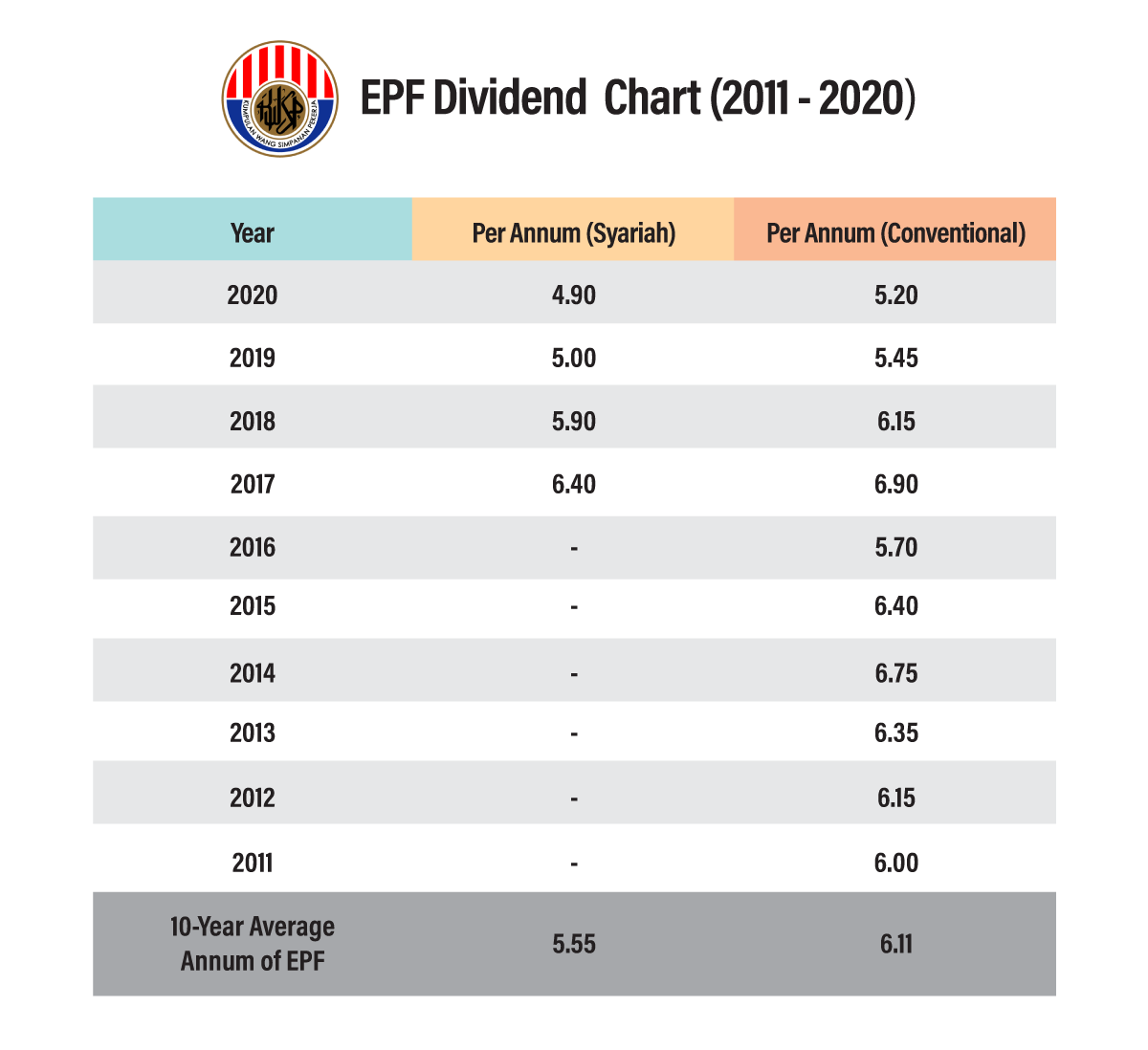

Epf In A Low Interest Rate Environment

Basic Savings Table Epf For Unit Trust Consultant 2018 Myunittrust Com

Does Interest Rate Increase Make Epf An Attractive Investment Option

Pin On Epf Kwap Ltat Lth Pnb Ptptn

Epf A C Interest Calculation Components Example

Epf Contribution Rates 1952 2009 Download Table

Epf Contribution Rates 1952 2009 Download Table

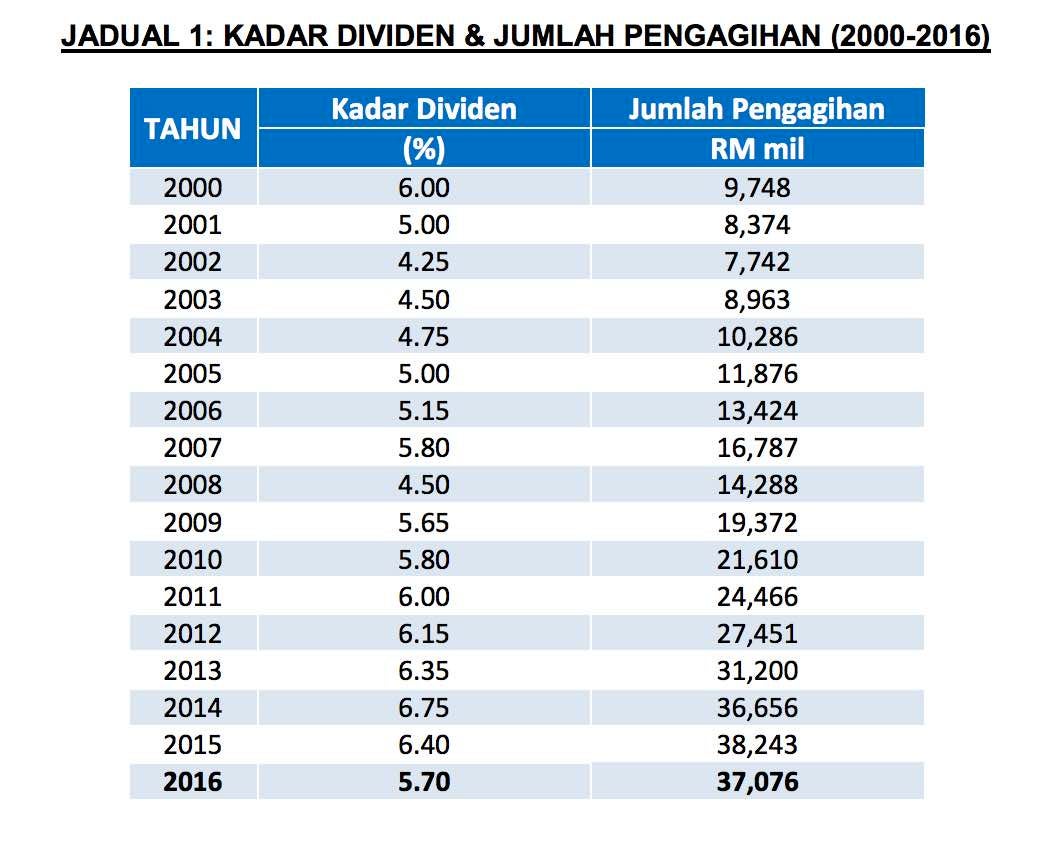

Epf Kwsp Dividend Rates 2019 Otosection

Epf Will Reach Rm1 Trillion Soon But Reaching The Next Trillion May Be Harder The Edge Markets

20 Kwsp 7 Contribution Rate Png Kwspblogs